Stocks continued to retreat as losses on Tuesday were large enough to push the market down more than 2% for the second week in a row. The S&P 500 has retraced 6.7% of its massive rally from the lows in March.

Key Points for the Week

- The S&P 500 fell for the second straight week as technology shares lagged and cyclical and low-volatility sectors outperformed.

- Inflation is increasing as some prices are adjusting to higher costs and increased demand in key sectors.

- Brexit is back: Great Britain’s actions are increasing the risk of a no-deal Brexit.

As expected, low-risk sectors have outperformed. Using data from the broader MSCI USA index, utilities, health care, and consumer staples have all outperformed the broad market industry. The decline from the Sept. 2 highs has also hit the best-performing sectors. Technology, consumer discretionary, and communication services have fallen more than the average sector. More cyclical sectors, such as financials and industrials, have held up better after underperforming much of the year. (See Table 1.)

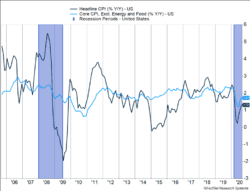

Inflation rose sharply for the second month in a row, as shown in Figure 1. Core CPI rose 0.4% and is now up 1.7% year-to-date. After prices fell early in the pandemic, greater demand and additional costs to promote safety have contributed to faster price increases.

Global stocks, represented by the MSCI ACWI index, fell 1.2% last week, reinforcing the theme that the strongest performers (the U.S.) are giving back the most in this short downturn. The Bloomberg BarCap U.S. Aggregate Bond Index gained 0.2%.

Next week’s economic data will feature retail sales and industrial production in the U.S. and China, the two largest global economies. The Federal Reserve meets but is not expected to take major action as existing policy efforts are generally working. We are also watching Brexit negotiations between Great Britain and the European Union. Recent moves by the British government raise the risk of a no-deal Brexit, which threatens parts of the global economy at a point when the recovery seems to be slowing.

Figure 1

| Index | Since 09/02/2020 |

| MSCI USA IMI/Comm Svc | -8.3% |

| MSCI USA IMI/Cons Disc | -7.6% |

| MSCI USA IMI/Cons Staples | -3.3% |

| MSCI USA IMI/Energy | -7.7% |

| MSCI USA IMI/Financials | -3.4% |

| MSCI USA IMI/Health Care | -4.7% |

| MSCI USA IMI/Industrials | -3.3% |

| MSCI USA IMI/Information Tech | -11.3% |

| MSCI USA IMI/Materials | -2.3% |

| MSCI USA IMI/Real Estate | -3.8% |

| MSCI USA IMI/Utilities | -2.8% |

Table 2 – Source Morningstar Direct

Run of the Mill Downturn

Investors’ emotional reactions to market declines seem to follow a consistent script. First, there are multiple factors that point to risk being elevated. Then, some seemingly small, or hard to identify, event unsettles investors, gets magnified by other investors, and stocks move lower. The trend continues for a while. Eventually, markets stabilize, and investors start forgetting the emotional experience of the decline.

Thus far, the current downturn seems to be following the same script. Markets had risen very sharply from the lows in March. Certain sectors, often related to technology, had bounced higher in a business environment favoring companies able to support social distancing. What triggered the decline is hard to say. High valuations or indications that technology earnings could only grow so fast are two possibilities. Some investors responded to signs the market increase might fade and took profits.

The S&P 500 and the MSCI USA index both dropped 6.9% from the low before rebounding slightly later in the week. Markets could certainly go lower, but an approximately 7% decline is a normal part of investing.

The normal decline has produced “run of the mill” results:

- As shown in Table 1, the S&P 500 has dropped 6.7%, and the broader MSCI USA index, which includes mid-cap stocks, has fallen 6.9% since the Sept. 2 high.

- Low-risk sectors, including utilities, health care, and consumer staples, have performed better than the broad index.

- The sectors with the best performance year-to-date (consumer discretionary, technology, and communication services) have all trailed the broader market.

- Those sectors that have lagged, such as financials and industrials, held up better than average.

This moment presents a good opportunity to reassess your risk tolerance with your advisor. You may be experiencing some anguish about the pandemic and/or the election may be of outsized importance to you. Those feelings may be flowing over to your portfolio, which has likely recovered from the February-March decline, and you don’t want to go through that again.

If you don’t take advantage of these opportunities, the memory of the decline will fade. Do you remember how concerned you were about the markets in the fourth quarter of 2018? What about right after the last election? Our memories fade fast. In the end, focus on the risk you need and can tolerate. A little discomfort during a large decline is likely fine. If your emotions or situation make going through a large decline very difficult, this is a great time to act without facing the potential regrets of selling out at the bottom.

P.S. Except at the Mill and the Lot

Inflation jumped for the second month in a row after declining during the recent recession. Inflation data released last week showed core inflation, which excludes food and energy, rose 0.4% last month after rising 0.6% in July. Even with the surge, it is only up 1.7% over the last 12 months.

Price increases were broad-based, but two areas indicate further demand. Used car prices rose 5.4% as demand is surging. The price of lumber more than doubled this year after tripling at one point.

The increases support the view COVID-19 may spark a move away from commuter-based urban centers to more emphasis on working from home. Less use of public transportation and larger homes (with great home offices) are two trends we are watching to see how a post-pandemic world may be different.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.calculatedriskblog.com

Compliance Case: 00825614